Our analysis (ESG) for 2021

In 2020, we conducted a wide-ranging materiality analysis based on Euronext’s guidance on environmental, social and corporate governance (ESG) issues from January 2020. Conversations were held in that context with managers, sales personnel and employees as well as owners and clients.

This analysis was updated in the autumn of 2021 through further talks with not only managers, sales personnel and employees but also various other stakeholders. Megatrends and regulations were also reviewed. The analysis identified roles and responsibilities, stakeholders, the value chain and ESG-related risks and opportunities. That allows us to identify the direction for our further work.

Roles and responsibilities

Our priority areas

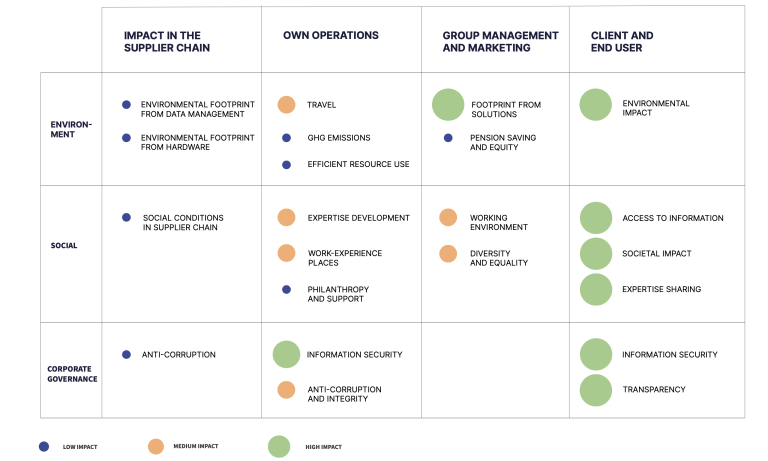

Sustainability will be a natural part of our business, and we will also be conscious of how we can influence the world in a long-term and responsible manner. Our value chain occupies a key place here. It shows how our operations can influence the ESG pillars –environment/climate, social and corporate governance. In other words, the value chain is our basis for determining where we can and should allocate resources, and how we can achieve the best possible effects with them.

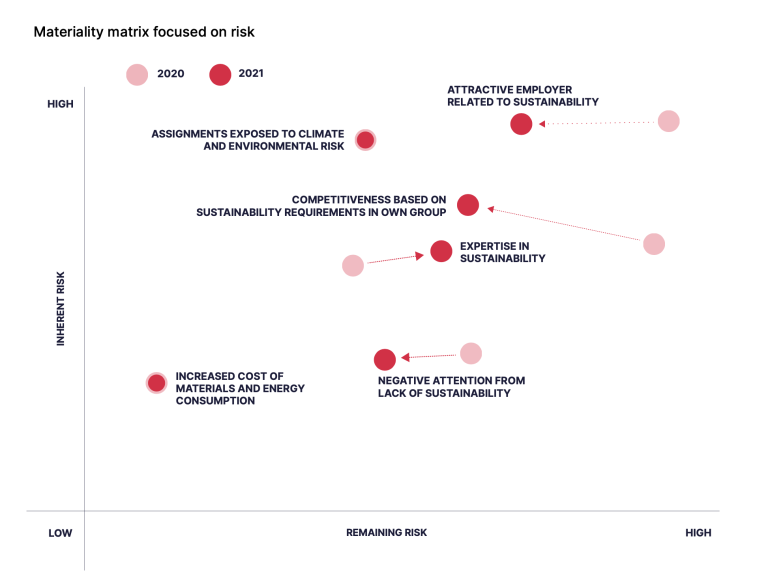

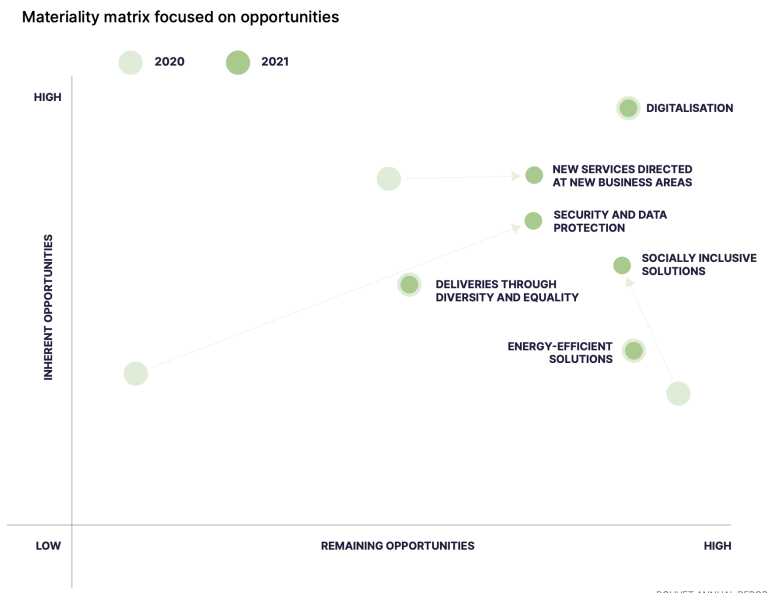

At the same time, our value chain forms the basis for the materiality analysis we updated in the autumn of 2021. This showed a growing maturity in the organisation’s work on our ESG-related risks and opportunities. Where our business is concerned, changes in 2021 primarily involved moving from project to implementation in the organisation – with areas of responsibility and approaches which accord with our regional model. This work will continue in 2022.

This showed a growing maturity in the organisation’s work on our ESG-related risks and opportunities. Where our business is concerned, changes in 2021 primarily involved moving from project to implementation in the organisation – with areas of responsibility and approaches which accord with our regional model. This work will continue in 2022.

Risks and opportunities identified by the materiality analysis will then provide direct guidance for the ESG-related meas- ures we choose to implement in the time to come.

It is up to each region to prioritise its own measures in relation to its specific position and the special challenges and opportunities faced in its area of operation. That comes in addition to what a region regards as prime opportunities for exerting influence in its work with clients and end users, in management, in marketing our group, in its own operations and in exerting influence on its suppliers.

However, we have identified four overriding priority areas for our ESG-related work in order to concentrate resources and create mutually reinforcing effects from measures. These are:

• we will pay attention to sustainability in all relationships with

clients and partners

• we will develop and share expertise on sustainability

• we will embrace an inclusive and diverse culture

• we will lead the way and keep our own affairs in order.

The measures we take will fall within one or more of these areas – and are directly related to the risks and opportunities in the materiality analysis.